QUICKBOOKS

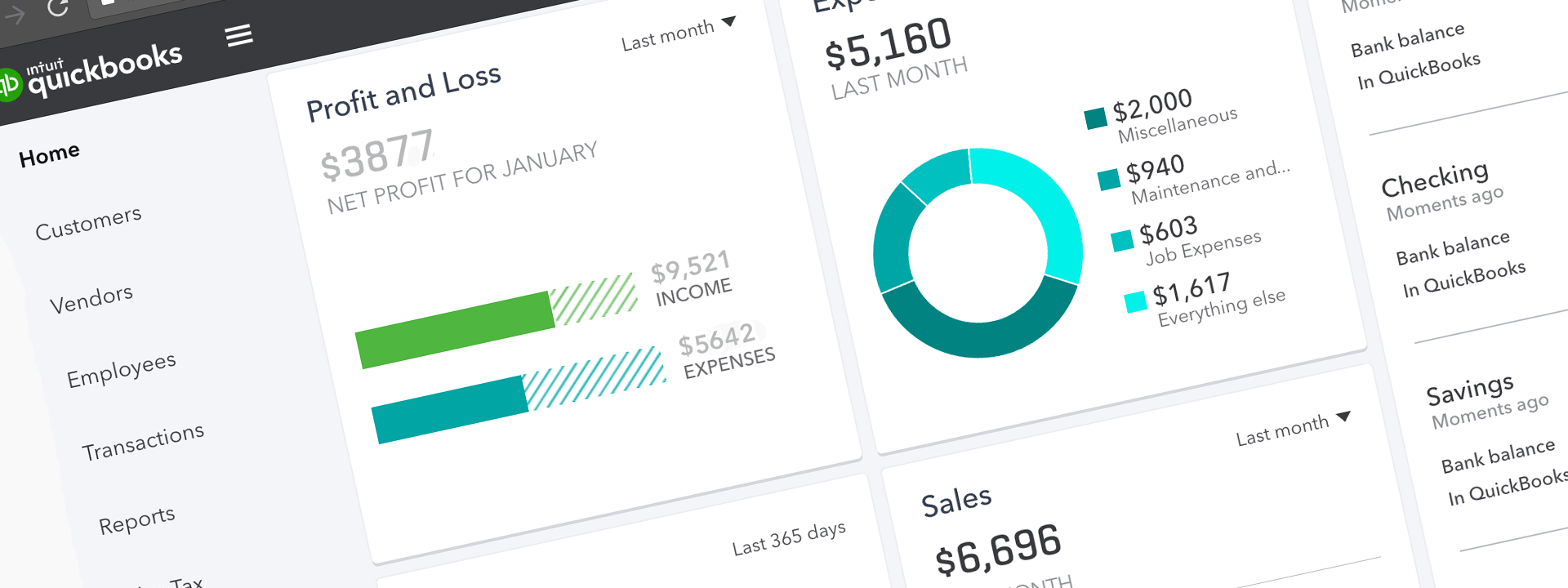

Our experience allows us to review your current bookkeeping system and your future bookkeeping needs, and then setup your QuickBooks program so that it works for you, flawlessly, right from the start. You don’t have to waste your time, or the valuable time of an employee, taking the time to figure out what methods of bookkeeping you use, what chart of accounts you will need for your business and how to properly enter beginning balances. As well, our experts provide training on the QuickBooks software, increasing efficiency and knowledge of your new bookkeeping method immediately rather than prolonging the inevitable learning curve as your bookkeepers figure out the ins and outs of the system.

At Integrity Tax and Accounting Firm we can guarantee that the professional setting and assisting your QuickBooks needs is a QuickBooks Pro Advisor, what is a QuickBooks Pro Advisor you ask?

A ProAdvisor is a QuickBooks-certified independent accounting pro who can provide strategic insights to drive small business success. Find an expert in: Accounting & Bookkeeping. Tax & Financial Planning. With a QuickBooks Certified ProAdvisor, you’ll be looking at and working on your books with someone that has advanced knowledge of how QuickBooks works. Anyone that is certified in QuickBooks has endured lessons and courses that have taught them all the tricks and nuances with this software. Plus, they have passed and become certified. These individuals know how to troubleshoot everything, even fixing out-of-balance balance sheets and technical issues with bank feeds. Another aspect of being certified in QuickBooks is that they are equipped to even train others on how to use QuickBooks. These skills can boost your business with productivity and efficiency in each department.

What Are the Benefits for Hiring a QuickBooks Certified ProAdvisor?

When you have a QuickBooks Certified ProAdvisor on your team, you have someone that is well-versed in accounting and bookkeeping services. They can simply act as an outsourced accounting department for your small and/or medium-sized businesses.

Here’s a short list of some of their capabilities:

- Invoicing customers

- Reconciling your accounts

- Paying bills

- Set up and customization of your QuickBooks software

- Troubleshoot technical issues or customizations

- Answer any technical questions

- They receive discounts on QuickBooks products that can be extended to clients

- Notified first of new products and updates

These professionals are your one-stop shop for exceptional bookkeeping and/or accounting needs. If your advisor is a CPA on top of that, then you can benefit by receiving monthly/quarterly book preparations and tax returns. This way you can finally plan well with the same individual for tax season. Your worries will diminish knowing that these particular advisors ensure compliance with all IRS code too.

Conclusion

Going with a QuickBooks Certified ProAdvisor over someone that is simply certified in QuickBooks will go a long way. You not only receive a various number of benefits and perks, but you will also gain peace of mind when it comes to your company’s finances. You’ll be working with a professional that continues their education in bookkeeping, accounting and QuickBooks software each year for recertification. At Integrity Tax and Accounting Firm, we are QuickBooks Certified ProAdvisor’s that are happy to help you and your business get back on or stay on track financially. If you have any questions, call us today!

Ready to get started?

[vfb id=1]